Declining deposit and time deposit interest rates would force banks to change their business strategy, and will eventually force the industry to return to the basics of traditional banking. Banking industry leaders admitted that the industry has been spoiled by the largesse coming out of the government’s heavy borrowing in the last five years as enjoyed by their high interest rates offered to their clients.

This is the perfect time for banks to grow their traditional businesses, namely lending like personal loans, commercial loans, home loans, auto loans and deposits.

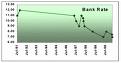

The industry is expecting a big squeeze in the government securities business as benchmark rates continued to slide to historical lows as evidence by the all time low t-bill rates, banks clearly have to adjust.

However the shifting conditions in the banking industry would create opportunities for banks present only in market with sufficient depth and liquidity. Traditional depositors and investors would want more sophisticated and varied ways to grow their money, they would likely go into pooled funds, UITFs or consider other financial services that banks could provide them.

Bank regulators are not expecting the low interest rates regime to be short-lived either. It is projected there will be a significant increase in bank lending especially since banks have very little else to do with their funds. Interest rates are merely responding to macro-economic factors that are not likely to change anytime soon, particularly the government’s declining need to borrow funds and the strong peso to dollar exchange rate that we are enjoying due to favorable market conditions and OFWs dollar remittances.

No comments:

Post a Comment