Predatory lending

Predatory lending is the practice of convincing borrowers to agree to unfair and abusive loan terms due to the sudden need of cash of the borrower.

Predatory lending normally occurs on loans backed by some kind of collateral, such as a car or house, so that if the borrower defaults on payment, the lender can profit by selling the repossessed or foreclosed asset. Other types of lending sometimes also referred to as predatory include payday loans, credit cards, and overdraft loans, when the interest rates are considered unreasonably high.

Most of the horror stories you hear here in the Philippines about this type of predatory lending is the credit card. Most companies charge around 3.5% per month of interest and normally around 500php for late payments. That's an outstanding

3.5% interest rate compunded monthly per anum if you only manage to pay the minimum amount due every month in which you are likely to incur 42% to 50% annual interest over creditcard purchases.

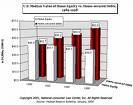

Picture: www.consumerlaw.org

Related Links:

Loan Guarantees

Getting a bank loan for your business

Mortgage Refinancing

Secured Loans

Consolidation Loan

Credit Cards

Home Equity Credit Line Loan

Debt Collection Agency

Personal Bankruptcy

Investment Fraud

Debt Management guide

3 comments:

ayos na pala dre.. napalitan mo na rin..

na link na rin kita..

moeny lending? marami din dito niyan.. 5%-12% ang interest/month... alam mo naman meron tayong mga kababayan na may mga luho ang maga naiwang pamilya sa pinas.. so minsan nanghihiram sila kung di sapat ang sahod..

oo nga eh. dapat simple lifestyle lang. If di naman ganon ka kailangan dont give in to the temptation. In the end you might end up paying it your whole life

how'd you find my site man? anyway, i already linked you.

Post a Comment